BDC Weekly Update: Starting To See Some Entry Points

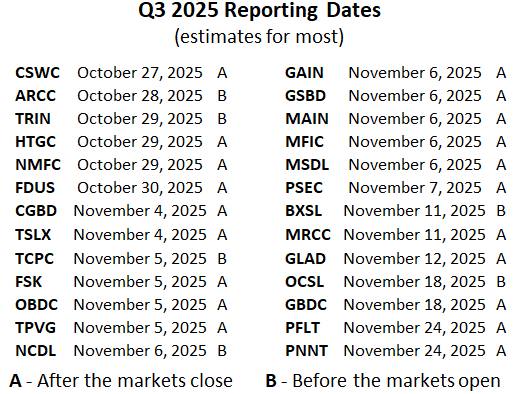

BDCs will begin reporting results in five weeks, and there is a chance that I will be making additional purchases of my smaller positions before the report. As always, I will notify subscribers of ANY changes to my portfolio.

Please use the following link to access all the recently updated reports, including side-by-side comparison reports and individual company updates:

BDC Market Quick Update

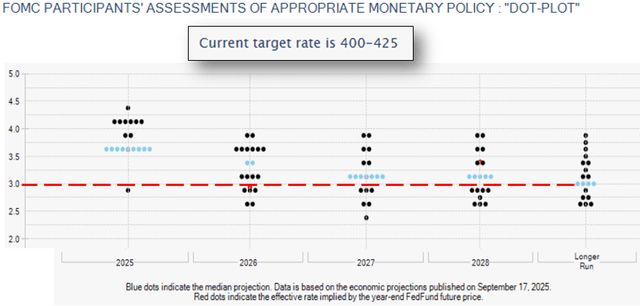

Last week, the Fed provided updated projections (and rate decision), partially responsible for pricing volatility during the week. Fed Chair Jerome Powell characterized the reduction as a risk management move meant to preempt further softening of the labor market. However, there was no significant change in the longer-term rate expectations, with the median projection remaining at 3.00%. If you are concerned about potential reductions in regular dividends for your BDCs due to the Fed cutting rates, please read the Dividend Coverage Levels report provided earlier this month (mentioned later).

As expected, BDC prices continued to pull back last week, with the average lower by 2.4%, mostly related to many BDCs having ex-dividend dates, including ARCC, FDUS, FSK, GBDC, NMFC, OCSL, TCPC, TPVG, and TSLX, for their regular quarterly dividends. Also, CSWC, FDUS, MAIN, and TSLX had supplemental dividends, and CSWC, PFLT,and PNNT had dates for their regular monthly dividends. Excluding these BDCs, the average was lower by around 0.7%.

However, there were a handful of BDCs that underperformed beyond the impact of their dividends, including FSK, which was lower by another 9.6%, and will be among the worst-performing for 2025. As discussed earlier this month in the “FSK Q2 2025 Update: Dividend Reduction In 2026”, FSK reported a 6.2% decline in NAV per share, with dividend coverage of only 85% for Q2 2025, and there will likely be a reduction in shareholder distributions starting in 2026.

As expected, PSEC continues lower (down another 4.7%), likely due to a ‘dead cat’ bounce from the previous rally, and remains the worst-performing BDC for 2025. Please see the ‘Q2 2025 Results Quick Update’ section later, showing PSEC with the largest NAV declines. Also, it is important to note that its non-accruals remain low simply related to having lower quality management, which will either keep an underperforming loan on accrual status or exit/restructure the loan before the end of the quarter so that it does not show up as non-accrual. During calendar Q2 2025, PSEC had over $308 million of realized losses.

TCPC and TPVG were the other meaningful underperformers and will likely have dividend coverage issues over the coming quarters, as discussed in the Dividend Coverage Levels report.

TRIN was the top performer, higher by another 2.2%, potentially related to the recent announcements of new investments (please see the #TRIN channel in Discord for details). This will be taken into account with the updated projections, along with likely issuing meaningful amounts of new shares to fund portfolio growth in Q3 2025. However, TRIN is now trading near its LT target price with an RSI over 73 (overbought territory). As mentioned later, TRIN announced that it was maintaining its regular dividend for Q3 2025, and over the coming weeks, we will be providing the projected dividends for 2026 (for all BDCs).

CSWC was the other meaningful outperformer, higher by another 1.4%, and continues to outperform. As mentioned in previous updates, CSWC was expected to be among the top performers for 2025, partially related to switching to a monthly dividend, which is popular with retail investors.

The only other BDCs in positive territory were HTGC and GLAD. However, GLAD’s small price rebound could simply be related to the previous weeks of underperformance and starting the week with the lowest RSI at 22 (extremely oversold territory). Also, GLAD recently announced a supplemental cash distribution of $0.10 per share for Q3 2025. As mentioned in the previous weekly updates, GLAD has been underperforming due to previously being overpriced (trading over its LT target), combined with the recently issued coverable notes with potential dilution and influencing dividend policy, as well as an 'overhang' on the stock price. GLAD is now trading more in line with the other BDCs, at around 9% below its LT target.

As discussed later, HTGC was finally upgraded by Moody’s to ‘Baa2’, similar to many of the other higher-quality BDCs, including ARCC, BXSL, GBDC, and TSLX.