CSWC Preliminary Results: Q2 2025

Please use the following link to access all the recently updated reports, including side-by-side comparison reports and individual company updates:

CSWC Quick Q2 2025 Update

Capital Southwest ( CSWC 0.00%↑ ) announced its preliminary operating results for the quarter ended June 30, 2025.

Pre-tax net investment income is in the range of $0.60 to $0.61 per share. Net investment income is in the range of $0.58 to $0.59 per share.

Net asset value per share as of June 30, 2025, is in the range of $16.55 to $16.65.

Non-accruals as a percentage of the total investment portfolio at cost and fair value are 2.6% and 0.8%, respectively.

This implies the following:

NAV per share decreased by around 0.6% (previously $16.70).

Non-accrual investments decreased from 1.7% to 0.8% of the portfolio fair value (from 3.5% to 2.6% at cost), likely due to Zips Car Wash being restructured (as discussed in the Deep Dive report linked below).

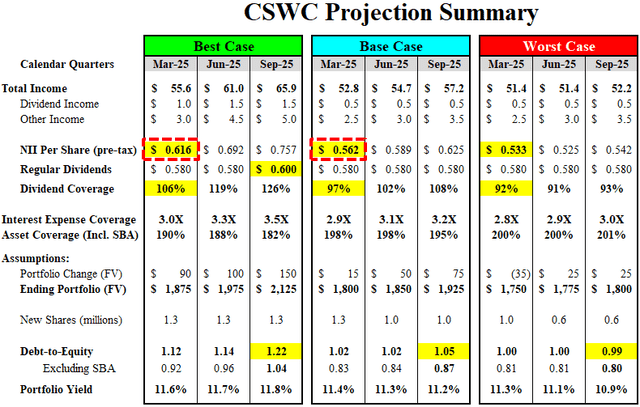

Pre-tax earnings are between my previous base case projection of $0.562 per share and best-case projection of $0.616 per share, likely covering its regular dividend by over 104%.

Please see the full CSWC Deep Dive Projections report at the following link, with the previously updated watch list, dividend projections, and target prices:

Please keep in mind that NAV per share was $16.60 as of June 30, 2024, implying stable over the last four quarters.

More importantly, was the meaningful decline in non-accrual investments likely due to Zips Car Wash being restructured:

Previous call: “We placed one new company on non-accrual, which post-quarter end completed a bankruptcy process and will likely be removed from non-accrual in the June 30 quarter.”

Capital Southwest will release its finalized Q2 2025 results on Wednesday, August 6, 2025, after the market closes. In conjunction with the release, Capital Southwest has scheduled a live webcast on Thursday, August 7, 2025, at 1:00 p.m., Eastern Time. Investors may participate in the webcast.