FSK Q2 2025 Update: Dividend Reduction In 2026

FSK Quick Quarterly Update (June 30, 2025)

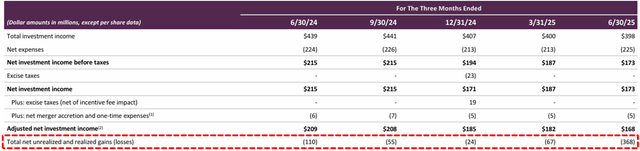

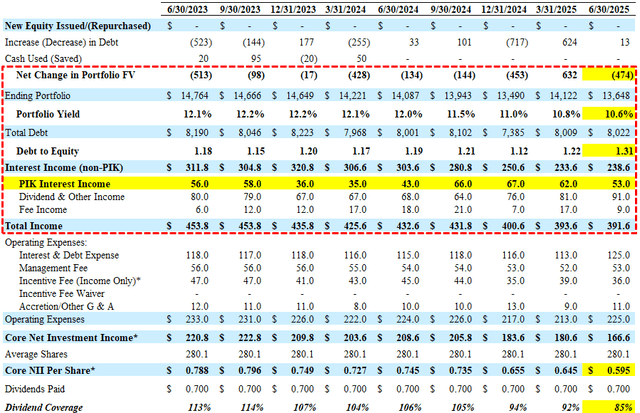

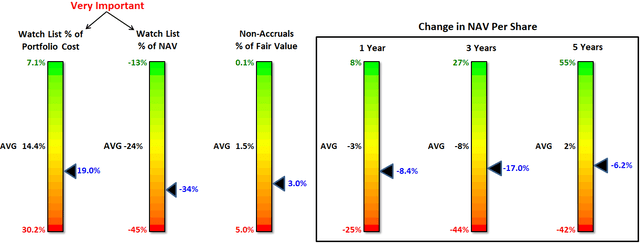

Earnings: Reported below its worst-case projections, mostly related to non-accruals increasing from 3.5% to 5.4% of the portfolio at cost, combined with lower fee income and lower portfolio yield (as expected). Its debt-to-equity ratio continues to increase and is now above its upper targeted ratio of 1.25, with only 85% dividend coverage.

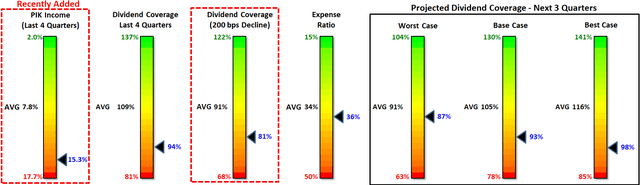

PIK Income: Remains extremely high at around 14% of total income for Q2 2025, but has averaged around 15% over the last four quarters.

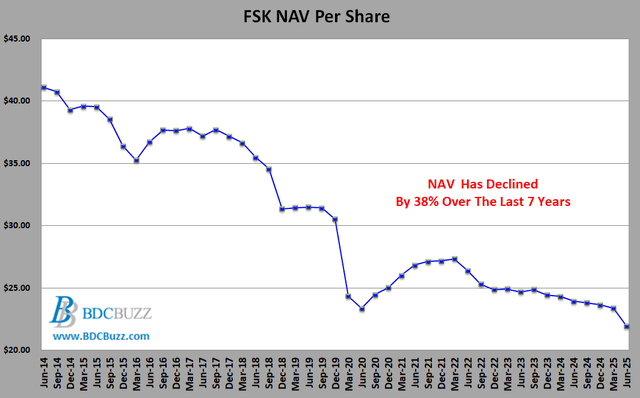

Net Realized Losses: Another $135 million or $0.48 per share, mostly related to exiting a portion of its non-accrual investments. Over the last 10 years, FSK has had over $1.6 billion, or around $5.87 per share of net realized losses (among the worst).

Dividends: Maintained its base dividend of $0.64 per share plus a supplemental dividend of $0.06 per share for a total of $0.70 per share for Q3 2025 (base case projection).

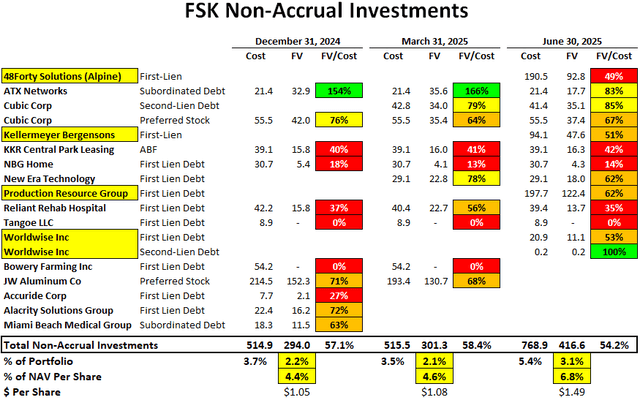

Credit Quality: Non-accrual investments increased from 2.1% to 3.1% of the total portfolio at fair value (5.4% at cost), mostly due to adding some of its watch list investments in 48Forty Solutions, PRG, Worldwise, and Kellermeyer Bergensons, partially offset by removing JW Aluminum, which remains a non-performing asset (coupon was removed). Please note that FSK has among the highest amounts of non-accruals, even before taking into account many additional loans to non-accrual companies that remain on accrual status. Also, Peraton and Medallia remain a concern.

NAV Per Share: Decreased by another 6.2% (from $23.37 to $21.93) due to additional markdowns of its watch list investments (see below) and under-earning the dividends.

There are many factors to take into account when assessing dividend coverage for BDCs, including portfolio credit quality, realized losses, fee structures, including ‘total return hurdles’ taking into account capital losses, changes to portfolio yields, borrowing rates, the amount of non-recurring and non-cash sources of income, including payment-in-kind (“PIK”). Higher amounts of PIK is a potential indicator that portfolio companies are not able to pay interest expense in cash and could imply potential credit issues over the coming quarters. Most BDCs have around 2% to 8% PIK income, and I pay close attention once it is over ~5% of interest income. As shown below, the amount of PIK interest income has started to decline, but so has total income, and PIK remains around 14% of total income, which is among the highest in the sector (only TPVG and MRCC have higher amounts).

“We did pay out $0.70 on purpose this year, right? We had this excess spillover number that we wanted to guide down to a more target range. I think going into the year, we probably expected more rate moves than we've seen thus far, and we wanted to give investors consistency for '25, kind of take something off the table. But as I said, the factors of where we stand vis-à-vis the market and otherwise, we'll factor into how we look at the dividend on a go-forward basis.”

Please use the following link to access all the recently updated reports, including side-by-side comparison reports and individual company updates: