Dividend Coverage Levels

Summary

This is a very in-depth report that will be referred to over the coming weeks/months comparing dividend coverage ranked by the 'worst-case' financial projections and the lower yield Leverage Analysis.

Also, we discuss PIK income categorizing each BDC based on the amount, quality, and trend/direction that has been added to the Google Sheets.

We have updated the Dividend Coverage Levels tables to take into account the recently updated projections for each BDC.

Please read if you are concerned about potential reductions in the current regular dividends due to the Fed cutting interest rates this year and/or increased credit portfolio issues.

Worst-case scenarios for each BDC include increased portfolio credit issues, lower NAV per share, declining portfolio yields (potentially from lower interest rates, as discussed below), higher borrowing rates and operating expenses, slower portfolio growth (or portfolio declines/repayments), and lower amounts of non-interest income (from fees and dividends).

To see the full Dividend Coverage Levels report, please use the following link:

BDC Dividend Coverage Levels Update

BDCs Included: ARCC 0.00%↑ , BXSL 0.00%↑ , CGBD 0.00%↑ , CSWC 0.00%↑ , FDUS 0.00%↑ , FSK 0.00%↑ , GAIN 0.00%↑ , GBDC 0.00%↑ , GLAD 0.00%↑ , GSBD 0.00%↑ , HTGC 0.00%↑ , MAIN 0.00%↑ , MFIC 0.00%↑ , MRCC 0.00%↑ , NMFC 0.00%↑ , OBDC 0.00%↑ , OCSL 0.00%↑ , PFLT 0.00%↑ , PNNT 0.00%↑ , PSEC 0.00%↑ , TCPC 0.00%↑ , TPVG 0.00%↑ , TRIN 0.00%↑ , and TSLX 0.00%↑ .

The following Dividend Coverage Levels reflect potential dividend coverage mostly ranked by using the ‘worst-case’ financial projections and the lower yield Leverage Analysis discussed in the Deep Dive Projection reports for each BDC. Worst-case scenarios for each BDC include increased portfolio credit issues, lower NAV per share, declining portfolio yields (potentially from lower interest rates, as discussed later), higher borrowing rates and operating expenses, slower portfolio growth (or portfolio declines/repayments), and lower amounts of non-interest income (from fees and dividends). Basically, the worst case is assuming a deeper and extended recessionary environment coupled with declining interest rates.

However, even if the underlying rates eventually go lower, there is a good chance that most BDCs will continue to over-earn their regular dividends. The following chart shows the average dividend coverage over the last 10 years with the last 6 quarters averaging over 120% even after taking into account the recent/previous dividend increases. Many BDCs have opted to take a conservative approach when setting their regular dividends (just in case rates head lower) and are using supplemental/special dividends to pay out excess earnings. This means that if portfolio yields decline, we will see lower amounts of supplemental/special dividends but the regular dividends will be maintained especially ‘Level 1’ dividend coverage BDCs which are the ones that can cover their regular dividends by at least 90% using the lower-yield Leverage Analysis with a debt-to-equity ratio of 0.80.

The Fed funds target range declined by 2.25% (225 basis points) starting in Q3 2019 through Q1 2020 resulting in a decline in average dividend coverage from 109% to 102%. The only BDCs to cut their regular dividends were ‘Level 2’ except for GBDC which has subsequently increased it higher than the previous level (currently $0.39 compared to previously $0.33).

OBDC management discussed on the recent earnings call:

Recent OBDC Call: “We've tried to be really thoughtful about our dividends. When it was clear rates have gone up, and we felt really confident that the portfolio does not only to perform to generate a really much higher set function, higher level of income. And we thought about how do we -- what's the right way to share that with shareholders. And we introduced this notion of a supplemental dividend. So shareholders would have a very predictable understanding of how our earnings and higher rates that flow through to them. One of the think hard about, do we have the balance right and we looked at our peers and their payout ratios, and we did a lot of work around our portfolio and sensitize, as you would expect us to, as rates drop, and making some thoughtful assumptions about credit performance. Do we have a cushion to raise the dividend further? And we felt really comfortable that even in a lower rate environment and making some appropriate assumptions around credit quality that we have more than enough cushion to raise the dividend an additional $0.02 a share. And so we did that. But what we would expect over time is if rates come down, we tend to look at the forward curve. We feel very comfortable continuing to earn our base dividend but we're putting more of our dividend in the base and the supplemental will be lower if rates come down. And I think that's a cushion as that supplemental. We just put up $0.51 a share. We raised the base of $0.37 a share. There is plenty of cushion there. And so we felt really comfortable. So to fundamentally answer your question, we looked at it holistically. We're going to just keep doing exactly what we're doing. We feel really confident in our portfolio. We don't need to change any levers, we will continue to do what we had, stay in our target leverage range, so would like to tweak that higher, continue to invest in some of our specialty finance verticals, those are accretive, especially in the lower rate environment. But fundamentally, we just continue to deliver great credit performance, and we feel good about the new dividend model.”

It is important to point out that lower rates have many benefits for BDCs including improved portfolio credit quality (lower payments and higher coverage ratios for portfolio companies), increased NAV per share, and lower yield expectations from investors resulting in BDCs heading back to LT targets, as discussed in the BDC Pricing & Market Update report.

Please note that if rates do head lower it could be excellent timing to refinance fixed-rate borrowings (many maturing 2025 through 2027) and/or benefit from lower borrowing rates on unused credit facilities with higher leverage. BDCs have many levers to pull to maintain or even increase dividends. Most BDCs are locking in new loans at higher rates with floors, and that might continue even if interest rates go down given the current market conditions including a “lender-friendly environment” with “higher overall yields”, better terms, and stronger covenants (safer investments) which are taken into account with the best-case projections. This is discussed in each of the Deep Dive reports including notes from the earnings calls.

Also, many BDCs achieve incremental returns with equity investments that are sold for realized gains often used to pay supplemental/special dividends. These BDCs include ARCC, GAIN, GLAD, FDUS, CSWC, PNNT, TPVG, HTGC, MAIN, and TSLX, as discussed in their reports.

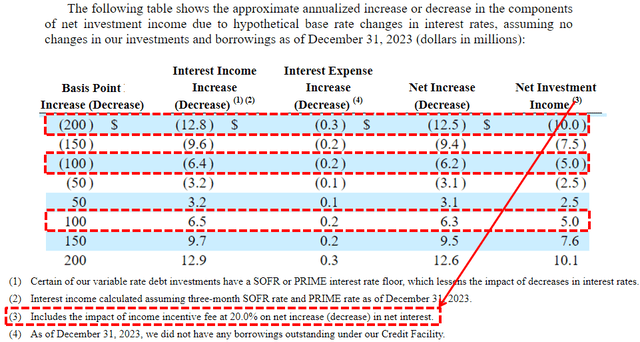

BDC Interest Rate Sensitivity

Interest rate sensitivity refers to the change in earnings that may result from changes in interest rates. Most companies report interest rate risk/opportunity in the ‘Quantitative and Qualitative Disclosures About Market Risk’ section of the regulatory filings. FDUS discloses more than most BDCs as they include the potential incentive fees paid (or reduced) when estimating net investment income (“NII”). Most BDCs do NOT include this information but I have taken this into account for each BDC when calculating the potential impact on NII.

Almost every BDC carefully matches assets and liabilities, including floating or fixed rates, terms/durations, and risk profiles. The following items are some items to keep in mind:

Fixed-rate borrowings typically are at higher rates than variable-rate credit facilities

Credit facilities have unused line fees

New investments for most BDCs have been at higher yields

Most floating-rate investments have floors of 25 to 100 basis points

Some portfolio companies will prepay loans

Prepayments often drive fee income

Capital from prepayments is typically used to repay variable-rate credit facilities

Incentive fees need to be considered for both positive and negative impacts

There are plenty of other considerations but implying that the impact of rising/declining interest rates is not as straightforward as the Interest Rate Sensitivity Analysis shown next for FDUS and included in the Deep Dive Projection reports for each BDC.

FDUS Interest Rate Sensitivity Analysis

The following is from the recently updated FDUS Deep Dive Projection report and includes the information from the previously shown SEC filing.

As of December 31, 2023, 66% of FDUS’s portfolio investments bore interest at variable rates, and only 3% of its borrowings were at variable rates. If rates decline by 200 basis points, FDUS would likely cover its regular dividends by 134%. However, this analysis uses the NII per share over the last four quarters and most BDCs have had higher earnings over the last two quarters as their portfolio yields increased. The next table takes this into account and uses the average NII per share over the last two quarters.

Comparing the Impact of Lower Interest Rates on Dividend Coverage

The following table shows:

Last two quarters of NII (GSBD/TPVG exclude fee waivers)

Annual/quarterly impact from lower interest rates (100 /200 basis points)

Quarter earnings adjusted for lower interest rates (100/200 basis points)

Current regular quarterly dividends

Dividend coverage using earnings adjusted for lower interest rates (100/200 basis points)

To see the full Dividend Coverage Levels report, please use the following link: